Indian equity benchmarks faced heavy losses on Wednesday after fresh 50% U.S. tariffs on Indian goods weighed on investor sentiment. The Sensex dropped over 700 points, while the Nifty 50 fell below the 24,550 mark, extending this week’s market weakness.

The impact was most visible in export-oriented industries. Shares of textile, footwear, and jewellery companies declined sharply, falling between 2–4%, while some firms with high U.S. exposure saw losses of up to 12%. Analysts said these sectors are directly vulnerable to the new tariff regime announced by Washington.

This comes on the back of an already volatile week. Over the past two sessions, Indian markets had lost nearly 1,500 points on the Sensex amid global uncertainty around trade and foreign investment flows. Foreign portfolio investors (FPIs) have pulled out over $2.6 billion in August, the highest monthly outflow in six months.

Market experts noted that while the tariff-driven sell-off has rattled equities, domestic institutional investors are expected to cushion the fall. They also pointed out that defensive sectors such as pharmaceuticals, IT services, and electronics may remain relatively stable in the near term, as their U.S. exposure is less tariff-sensitive.

Economists warn, however, that if trade tensions escalate further, India’s export-driven sectors could see pressure on earnings in the coming quarters. For now, trading is expected to remain volatile as global markets assess the full impact of the U.S. decision.

The Final Verdict On Japan’s Most Significant Political Crime In Decades Brings A Sense Of Closure To The Judiciary, Even As The Nation Continues To Grapple With The Social Fallout Of The Assassin’s Motives.

A National Tragedy In Spain Is Marked By A Singular Story Of Survival, Prompting A Massive Investigation Into The Safety Of The Country’s Iconic High-Speed Rail Infrastructure.

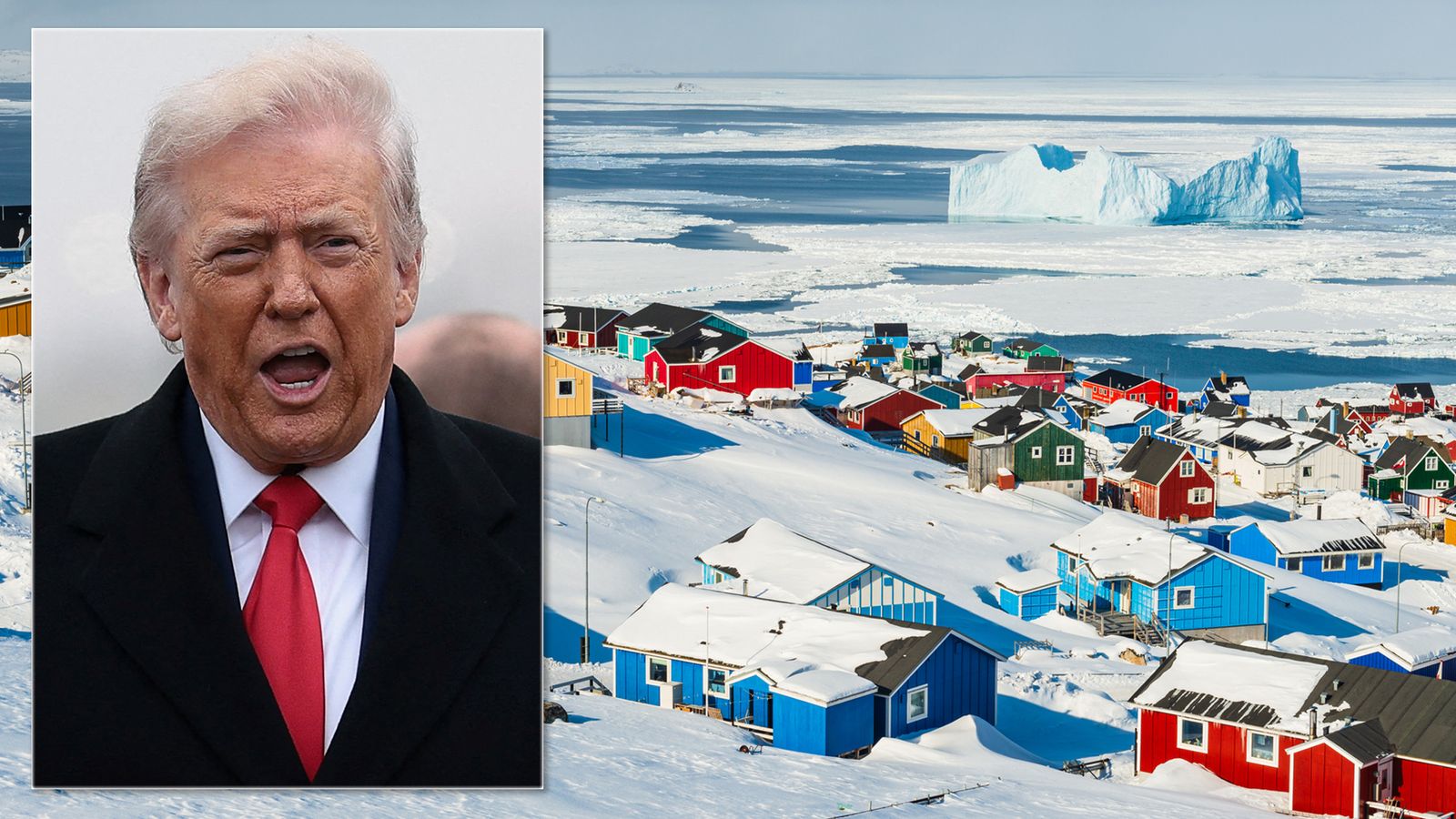

The Arctic Standoff Intensifies As President Trump’s Territorial Ambitions Clash With European Defenses, Marking A Volatile New Chapter In Trans-Atlantic Relations.

.png)

The High-Intensity Diplomatic Exchange In New Delhi Reaffirms A Shared Vision For A Terror-Free Future, With Both Nations Committing To A Robust Defence Framework To Guard Vital Global Interests.

President Trump Leverages Trade Weapons To Force A Sale Of Greenland, Setting The Stage For A Historic Economic Confrontation With Europe Over Arctic Sovereignty.

Medical Professionals Brave State Retaliation To Expose The Scale Of Bloodshed In Iran, Describing A Deliberate Campaign Of Lethal Force That International Bodies Are Now Labelling As Genocidal.

The White House Denounces Reports Of A Massive Buy-In Requirement For The President’s Peace Advisory Board, Affirming That Diplomatic Roles Are Not For Sale Under The Current Administration

Indian Embassy Continues High Level Push For Detained MT Valiant Roar Crew As Legal Battle Over Fuel Smuggling Charges Begins In Iranian Courts

Clandestine Satellite Terminals Pierce Iran’s Informational Blockade As Activists Risk Execution To Maintain The Revolution’s Only Link To The Outside World

Leaked Footage and Eyewitness Accounts Reveal Horrors of "Bloody Sunday" as State Forces Crush Protests in Near-Total Digital Darkness

Authorities Rule Out Widespread Tsunami Threat After 6.2 Magnitude Quake Off Oregon Coast, Though Residents Are Urged To Stay Clear Of Harbors Due To Unpredictable Currents

UK Lawmaker Bob Blackman Demands Diplomatic Action Against Minority Persecution In Bangladesh, Citing Murders And Temple Attacks Under The Interim Yunus Government

Former Congresswoman Amplifies Unverified Video Alleging Mass Visa Scams; Influencer Claims North Texas is Being Overrun

UN Security Council Remains Split Over Iran Unrest As Washington Pushes For Accountability Amid Mounting Evidence Of State-Led Violence Against Protesters

Kulman Ghising, credited with ending Nepal’s power cuts and reforming the energy...

NATO forces successfully intercepted a large-scale overnight drone raid launched...

Priya Sachdev’s lawyer has questioned Karisma Kapoor’s absence from Sunjay Kapur...

Qatar has strongly condemned what it describes as a “cowardly criminal assault”...

Karnataka Congress MLA Satish Krishna Sail has been arrested by the Enforcement...